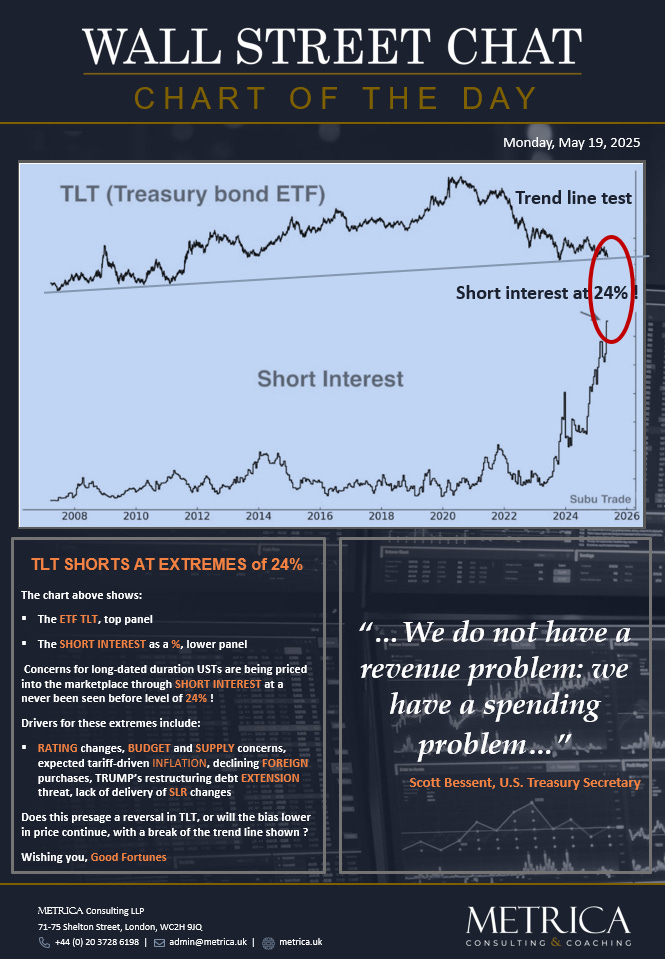

Chart of the Day: TLT 'Shorts' at Extremes

The chart below shows:

The ETF TLT, top panel

The SHORT INTEREST as a %, lower panel

Concerns for long-dated duration USTs are being priced into the marketplace through SHORT INTEREST at never been seen before levels of 24% !

Drivers for these extremes include:

RATING changes by Moodys, BUDGET and SUPPLY concerns, expected tariff-driven INFLATION, declining FOREIGN purchases, TRUMP’s restructuring debt EXTENSION threat, lack of delivery of SLR changes

Does this presage a reversal in TLT, or will the bias lower in price continue, with a break of the trend line shown ?

Wishing you, Good Fortunes